ASX hits another record, Qantas fined $90 million for illegally sacking 1,800 workers during the pandemic — as it happened

The ASX closes at another record high, just shy of 9,000 points on another day of solid profits.

In corporate news, Qantas has been fined $90 million in the Federal Court for illegally sacking 1,800 workers during the pandemic and NAB owned up to underpaying staff $130 million.

See how the day unfolded with news and analysis on our business blog.

Disclaimer: this blog is not intended as investment advice.

Editor's note 19/8/2025: This blog incorrectly referred to the ASX 200 closing just shy of 10,000 points on Monday. It closed just shy of 9,000 points. This has been corrected.

Key Events

Live updates

Market snapshot

- ASX 200: +0.2 at 8,959 points

- Australian dollar: +0.2% 65.16 US cents

- Asia: Nikkei +0.9%, Hang Seng +0.5%, Shanghai +1.1%

- Wall Street (Friday): S&P500 -0.3%, Dow +0.1%, Nasdaq -0.5%

- Europe (Friday): DAX -0.1%, FTSE -0.4%, Eurostoxx 600 +0.2%

- Spot gold: +0.4% to $US3,349/ounce

- Brent crude: +0.1% to $US 65.89/barrel

- Iron ore (Friday): flat at $US102.00/tonne

- Bitcoin: -1.8% to $US115,630

Prices current at around 4:15pm AEST

Live updates on major ASX indices:

Goodbye

That's it for another day on the blog, thanks for your company.

I leave you with the ASX 200 just 41 points shy of hitting the 9,000-point mark.

"Downtown" Dan Ziffer will be back in the saddle tomorrow morning and if anyone can get it over the line, it's Dan.

He'll have a busy day with another deluge of results, including BHP, CSL and Woodside.

Until next time ...

LoadingASX 200 hits another record close despite mining and energy stumble

The ASX 200 powered home to a fresh record close, up 0.2% to 8,959 points.

It's the sixth consecutive record close, leaving the index just 41 points shy of the 9,000-point mark - could this be the week it punches through?

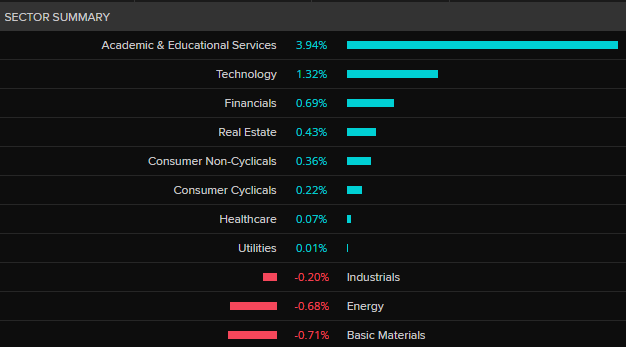

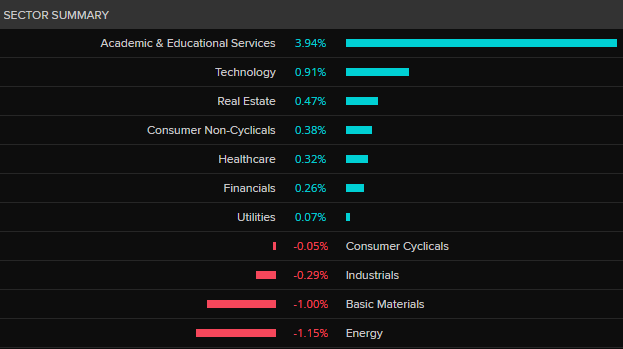

Winners and losers were evenly spread across the key sectors, with health care in favour and the mining and energy sectors being sold off.

The education sector outperformance was spurred on by its biggest player, IDP, gaining almost 4% after announcing it had picked up a new contract on Friday.

Energy plays were hit across the board; New Hope Coal -4.2%, Santos -1.1% and uranium miner Paladin -1.6%.

The banks were a mixed bunch, with investors looking through NAB's messy quarterly result (and a $130 million staff underpayment admission) to bid up the share price by 2.7%.

ANZ on the other hand fell 1.5%.

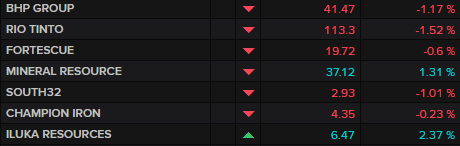

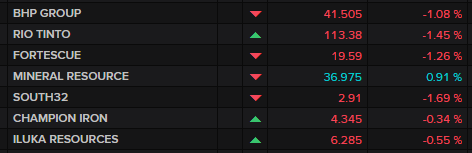

The big miners, BHP, Rio Tinto and Fortescue, were down between 0.5% and 1.5%.

There were some big swings among the session's key newsmakers.

- a2 milk: +3.3% on results

- Ampol: +0.3% on results

- Aurizon: +1.8% on results/job cuts

- Bluescope: -3.1% on results

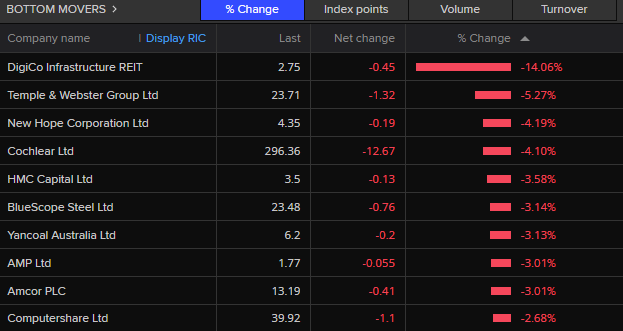

- DigiCo: -14.1% on results

- GPT: +1.9% on results

- GWA: +3.8% on results

- Iress: +1.2% on confirming takeover talks

- Kogan: -2.5% write-down of Mighty Ape brand

- Lendlease: +6.7% on results

- NAB: +2.7% on trading update

- oOh!media: -10.2% on results

- Qantas: -0.4% on $90 million fine

- REA Group: +4.5% on new CEO announcement

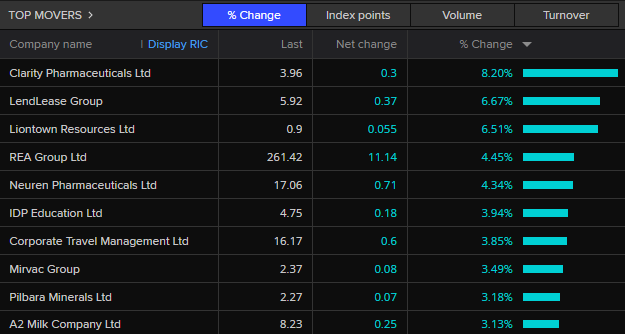

The top movers on the ASX 200 was Clarity Pharmaceuticals (+8.2%), while Lendlease gained 6.7% on the back of a strong result and a return to profitability.

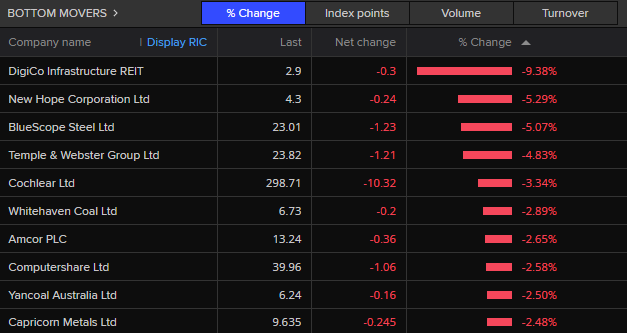

The ASX 200's bottom movers were data centre play DigiCo (-14.6%) on results, and retailer Temple &Webster (-5.3%).

ICYMI: Verrender on of the battle for Santos

Our venerable senior business correspondent, Ian Verrender hammered out this terrific piece on Abu Dhabi's bid to buy Santos (aka South Australian and Norther Territory Oil Search).

Well worth a read here:

Coming up on The Business

Happy Monday to you!

It's a big week for business - financial results season is in full swing and all eyes are on the federal government's economic reform round table which begins tomorrow in Canberra.

On tonight's The Business:

- Daniel Ziffer previews the three-day round table aimed at boosting the nation's productivity and economic resilience

- Lendlease CEO, Tony Lombardo, discusses possible productivity drivers in housing construction

- and the boss of Bluescope Steel, Mark Vassella, calls on the government to address the high cost of energy or watch the deindustrialisation of Australia.

Watch The Business on ABC News at 8.45pm, after the late news on ABC TV, or anytime on ABC iView.

Wall Street futures edge higher

Just a quick check of the screen to check in on Wall Street likely opening tonight.

The three indices are all a bit firmer at the moment.

- S&P 500 futures: +0.2%

- Dow futures: +0.1%

- Nasdaq futures: +0.2%

Cochlear slump today

Hello, what is behind the drop in COH shares today?

- Kim

Hi Kim, hard to say what's behind Cochlear's 3.4% slide today.

The healthcare sector is generally stronger, and recent FY result was solid enough.

Indeed, there's been a flurry of analyst notes from the big brokers upgrading their price targets for Cochlear (UBS, Morgan Stanley, Jarden, Macquarie and Wilson), which is generally enough to give a stock a bit of a lift.

Morgans appears to be the only broker with a downgrade.

The ex-dividend date is still a month away.

BHP, CSL and Woodside report tomorrow

It's a big day for blue chips tomorrow with three of the most widely held stocks on the ASX — BHP, CSL and Woodside — all releasing results.

BHP and Woodside are expected to entrench one of the big themes of this reporting season; the sliding returns from the big commodity plays, while CSL should show its steady growth in earnings is continuing.

The consensus view is that BHP will report a roughly 25% fall in net profit to $US10.2 billion, with higher earnings in copper not covering lower iron ore returns.

Dividends are expected to be cut by about a third.

Woodside profit is expected to drop from $US2.9 billion last year to around $US2.1 billion and the full year dividend is likely to be down around 25%.

The story at CSL is likely to be a bit different

Net profit should push through $US3 billion.

CSL has never been a massive dividend payer — preferring to put money away into R&D rather than showering shareholders with cash — but dividends are expected to $US2.96 per share, up from $US 2.64 per share last year on a slightly higher yield.

Given President Trump's threats to big pharma on "most favoured nation" drug pricing, CSL's commentary on US regulatory threats will be worth a listen.

UBS has estimated that CSL's future earnings could suffer a 5%-to-22% hit, depending on the regulatory outcome.

Hang in there

It seems like the stock market is feeling a bit like me today. It's a Monday towards the end of winter, and my motivation is gone, too.

- Monday blues . . .

NAB admits to underpaying more staff as payroll problems widen

National Australia Bank (NAB) is flagging a $130 million financial hit, revealing it underpaid staff wages and entitlements, as its payroll problems run deeper than first thought.

The major bank was warned its operating expenses for the financial year 2025 are now forecast to rise 4.5 per cent from the previous year, due to the cost of reviewing and remediating "payroll issues".

It comes more than five years after NAB first commenced a payroll review, which saw the bank repay millions to underpaid staff.

In an ASX release, NAB said its "payroll review and remediation is ongoing, and the total costs remain uncertain".

NAB chief executive Andrew Irvine said the costs of rectifying and remediating payroll issues were "disappointing" and the issue "must be fixed".

The bank's people and culture executive, Sarah White, apologised, saying, "Paying our colleagues correctly is an absolute priority."

Finance Sector Union (FSU) said it had expressed its disbelief with NAB that "one of the nation's biggest banks has once again failed to pay its workers correctly".

FSU national president Wendy Streets said the scale of underpayment was "nothing short of systemic wage theft", especially when Australians are struggling through the worst cost-of-living crisis in decades.

"NAB has been forced to make provisions of nearly $400 million to pay back its workforce over the last five years — money that should never have been taken from workers in the first place."

Read more from business reporter Yiying Li:

Will $55m penalty deter Google?

The head of the consumer watchdog Gina Cass-Gottlieb has just held a press conference about the $55m fine handed to tech giant Google for anti-competitive conduct.

The ACCC Chair said Google admitted it had breached competition law by inking deals with Telstra and Optus where Google Search was pre-loaded onto Android phones before being sold.

When pushed on whether the fine was really a deterrent for a dominant global player like Google — she had this to say.

"This is amongst the highest penalty that the ACCC has achieved from courts (on anti-competitive conduct). There is one higher at $57.5 million and that is under (legal) appeal," she said.

The Federal Court still has to put a rubber stamp on that penalty before Google pays up.

Ms Cass-Gottlieb said the ACCC had struck an agreement with Google that will benefit consumers by preventing it from striking similar anti-competitive deals with telcos and phone manufacturers.

That's important she says because Google has over 90 per cent of Australia's general search market sewn up and other companies are desperate to carve out a greater share, particularly with the rapid emergence of search tools powered by artificial intelligence.

"We go into the future from now with real choice for consumers and that is in fact not possible to put a price to…and the benefits that will bring for consumers in competition are of huge significance," she said.

The power of tech giants has been a focus of a major five-year Digital Platform Services inquiry by the ACCC which has pushed the Albanese government to beef up protections for consumers.

The government has responded positively to the inquiry but is yet to act.

In a statement, Google said it was pleased to resolve the ACCC's concerns and the commercial agreements were historical and no longer in use.

Newsmakers today

There have been some outsized moves in stocks lobbing statements in the ASX portal today.

Here's some of the action among the newsmakers:

- a2 milk: +1.3% on results

- Ampol: flat on results

- Aurizon: +1.8% on results/job cuts

- Bluescope: -3.6% on results

- DigiCo: -10.5% on results

- GPT: +3.7% on results

- GWA: +1.3% on results

- Iress: +1.3% on confirming takeover talks

- Kogan: -3.5% write-down of Mighty Ape brand

- Lendlease: +5.1% on results

- NAB: +1.9% on trading update

- oOh!media: -10.3% on results

- Qantas: -0.2% on $90 million fine

- REA Group: +3.4% on new CEO announcement

Qantas says $90m penalty 'holds us accountable'

Qantas has accepted the Federal Court's $90 million penalty for the airline's unlawful outsourcing of groundworkers during the pandemic.

Here is the airline's statement:

Today's judgement holds us accountable for our actions that caused real harm to our employees.

Qantas Group chief executive Officer Vanessa Hudson said: "We sincerely apologise to each and every one of the 1,820 ground handling employees and to their families who suffered as a result.

"The decision to outsource five years ago, particularly during such an uncertain time, caused genuine hardship for many of our former team and their families.

"The impact was felt not only by those who lost their jobs, but by our entire workforce.

"Over the past 18 months we've worked hard to change the way we operate as part of our efforts to rebuild trust with our people and our customers. This remains our highest priority as we work to earn back the trust we lost."

The $90 million penalty will be paid in accordance with the orders of the Court.

Qantas has also paid $120 million into the compensation fund for all affected former employees, which is being administered by Maurice Blackburn.

Read more of the judgement, which included Justice Lee saying Qantas had shown it was "the wrong kind of sorry":

ASX 200 flat as miners and energy stocks slump

The ASX 200 has bounced around to be around where it closed on Friday, relatively flat at 8,935 points (12:35pm AEST).

Winners and losers were evenly spread across the key sectors, with health care in favour and the mining and energy sectors being sold off.

The education sector outperformance was spurred on by its biggest player, IDP, gaining more than 4% on opening after announcing it had picked up a new contract on Friday.

Energy plays have been hit across the board; Whitehaven Coal -3.0%, Santos -1.2% and uranium miner Paladin -1.6%.

The banks are a mixed bunch, with investors looking through NAB's messy quarterly result (and a $130 million staff underpayment admission) to bid up the share price by 1.6%.

ANZ on the other hand was down 1.6%.

The big miners, BHP, Rio Tinto and Fortescue, are down between 1% and 1.5%.

The top movers on the ASX 200 are healthcare stocks such as Clarity Pharmaceuticals (+7.1%) and Polynovo (+5.9%), while Lendlease is up 4.9% on the back of a strong result and returning to profitability.

The ASX 200's bottom movers are data centre play DigiCo (-9.4%) on results, and coal miner New Hope (-5.3%), while investors didn't like the look of Bluescope's profit slump (_5.1%).

Market snapshot

- ASX 200: flat at 8,935 points

- Australian dollar: +0.2% 65.15 US cents

- Asia: Nikkei +0.9%, Hang Seng +0.3%, Shanghai +0.8%

- Wall Street (Friday): S&P500 -0.3%, Dow +0.1%, Nasdaq -0.5%

- Europe (Friday): DAX -0.1%, FTSE -0.4%, Eurostoxx 600 +0.2%

- Spot gold: +0.3% to $US3,343/ounce

- Brent crude: -0.1% to $US 65.78/barrel

- Iron ore (Friday): flat at $US102.00/tonne

- Bitcoin: -1.5% to $US115,877

Prices current at around 12:30pm AEST

Live updates on major ASX indices:

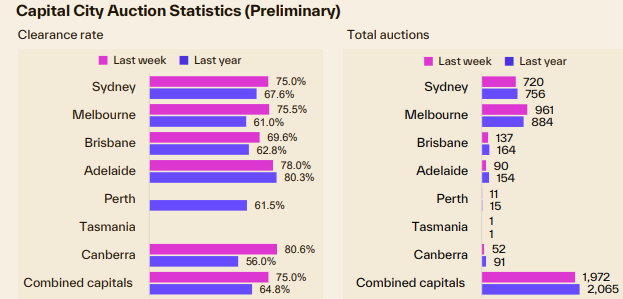

Auctions respond to rate cut

Last week's rate cut from the RBA has translated into an immediate bounce in the auction market.

Clearance rates rose more than 3% with almost 25% more properties on the market from the week before, on data collected by Cotality.

Nationwide clearance rates hit 75%, the highest rate in since April last year.

ASX making gains at midday, on track to a new record close

After a slow start, the ASX is gaining momentum.

At 12pm (AEST) the ASX 200 was up 0.2% to 8,955 points and on course for another record close.

Tech giant in trouble again over anti-competitive behaviour

Consumer watchdog the ACCC has fined Google $55 million after it admitted it struck deals with the nation's two biggest telcos, Telstra and Optus, to pre-install Google Search on Android mobiles.

The deals, which were in place between December 2019 and March 2021, meant Search was put onto phones before being sold to the public — effectively giving Google an illegal advantage over its competitors.

Telstra and Optus then received a cut of the lucrative ad revenue seen by those customers when they used Google Search.

Google has agreed to remove pre-installation and default restrictions from contracts with Android manufacturers and telcos.

The ACCC says the deal means millions of Australians will have greater choice of search providers in the future.

It's the second recent blow for Google, which last week lost a Federal Court case.

The court found Google had misused its market power in the way it had operated its Google Play store, clearing the way for a massive consumer class action to seek compensation for over-charging an estimated 15 million people.

NAB shares higher despite underpayment admission

NAB's share price has climbed more than 2% this morning with investors embracing the solid revenue growth story rather than the unexpected cost of remediating underpaid staff and the increase in bad debts.

J.P. Morgan analyst Andrew Triggs said the third quarter result was very strong but "a little messy" given the payroll remediation.

He said the quarter's net profit of $1.77 billion was well ahead of his forecast and was driven by higher-than-expected margins.

However, Mr Triggs was less impressed by cost growth at NAB and higher credit impairment charges.

Cost growth is up 4.5%, largely on the back of an additional $130 million being set aside to sort out another staff underpayment issue at the bank.

Credit impairment charges were raised to $254 million, while non-performing loan rates were kicked up 5 basis points.

UBS analyst John Storey noted while cash earnings were largely in line with his forecasts, revenues were better, but costs and impairments were higher than expected.

Qantas shares fairly flat

Shares in Qantas have recovered ground after the magnitude of the fine was revealed. A short time ago they were pretty much unchanged, regaining an earlier 1 per cent-plus fall.