ASX higher despite CSL shares falling for second day, James Hardie nosedives — as it happened

The Australian share market has closed higher, led by strong gains for the major banks and other financial stocks.

Reporting season continues, with a big sell-off for James Hardie shares on a profit plunge, while CSL has declined again after yesterday's results.

Look back at how the trading day unfolded on our blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

Submit a comment or question

Live updates

Market snapshot at the close of trading

- ASX 200: 0.25% to 8,918 points

- All Ordinaries: 0.04% to 9,177 points

- Australian dollar: -0.2% at 64.38 US cents

- Wall Street: Dow Jones (flat), S&P 500 (-0.6%), Nasdaq (-1.5%)

- Europe: FTSE (+0.3%), DAX (+0.5%), Stoxx 600 (+0.7%)

- Spot gold: 0.3% to $US3,323/ounce

- Oil (Brent crude): +0.7% to $US66.3/barrel

- Iron ore: -0.8% to $US100.70/tonne

- Bitcoin: flat at $US113,655

Prices current around 4:25pm AEST

Live updates on the major ASX indices:

Goodbye from us

Thank you for joining us today.

Don't forget to tune in to The Business program with host Alicia Barry tonight at 8.45pm on ABC News Channel.

We'll be back on the blog early tomorrow morning.

Goodbye!

LoadingMarkets at the close

Local share markets closed up today, despite the tech-led falls on Wall St overnight.

The ASX 200 closed up 0.25% to 8,910 points while the All Ordinaries closed up 0.04% to 9,177 points.

The Reserve Bank of New Zealand cut the official cash rate by 0.25% to a three-year low of 3%.

Committee members debated whether to cut by 0.25 or 0.5 percentage points and ultimately voted 4 to 2 members for the smaller cut.

There were a number of profit results out today, including Stockland which posted a bumper profit which led to its shares soaring to a 17-year high.

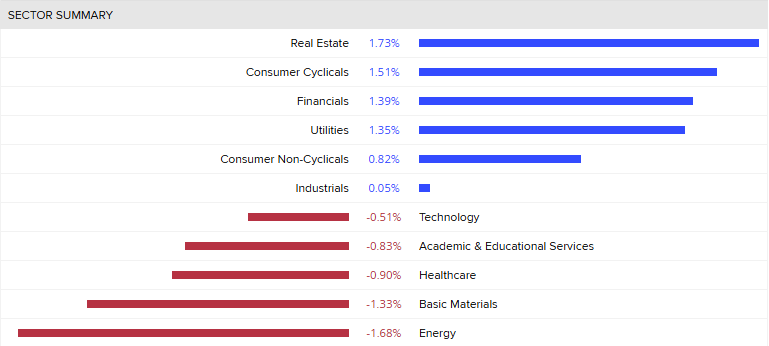

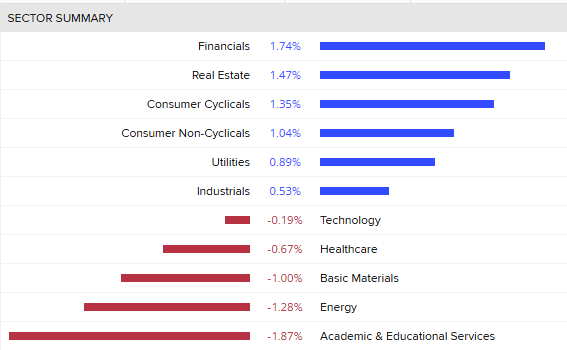

Real estate, consumer cyclicals and financials led the sectors today, while energy and basic materials dragged down the markets.

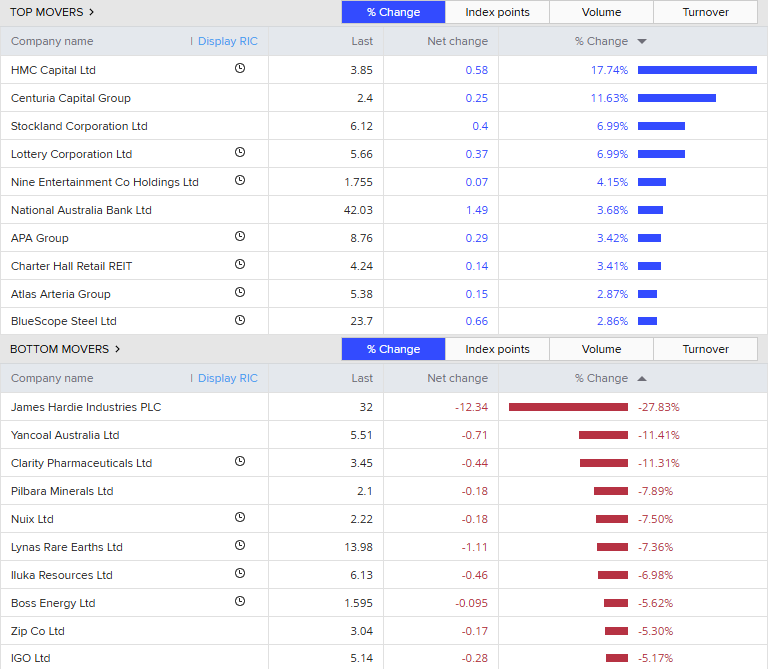

HMC Capital recovered from a poor performance yesterday and ended up leading the top stocks after Morgans changed the stock from a 'hold' to a 'buy'.

The worst performing stock today was James Hardie, which closed down almost -28% after posting disappointing results and forecasts.

China's Tianqui open to renegotiating on lithium refinery deal

The boss of Tianqi Lithium, Frank Ha, says he's open to renegotiating with its joint partner regarding the troubled Kwinana lithium refinery in Western Australia.

The refinery, the first lithium hydroxide plant to be built in Australia, has faced operational issues and production delays amid a price slump.

IGO, which owns a 49% stake, wrote down the refinery when it reported last month.

Tianqui Lithium and IGO also share ownership of the Greenbushes lithium mine (one of the world's most valuable).

"I am open to any of their proposals that we can discuss, but until now we have not received any official proposals from them," Ha said during a media briefing.

Mr Ha says efficiency at Kwinana was improving and the company had no plans to shut down the refinery.

-with Reuters

Have you noticed an increase in the price of your Sunday roast?

A traditional lamb roast is out of reach for many Aussie families these days.

That's because a leg of lamb has doubled in price in the past 18 months.

More households are opting for cheaper cuts of meat.

How about you?

Almost $104 billion in wages paid in June

Employers paid almost $104 billion in wages and salaries in June, up almost 6% from the same month in 2024, according to figures released by the Australian Bureau of Statistics.

"Total wages and salaries paid by employers totalled $1,219 billion in the 2024-25 financial year, growing 5.9 per cent from the 2023-24 financial year," said ABS head of labour statistics, Sean Crick.

"This was lower than the 7 per cent between the 2022-23 and 2023-24 years."

By adding 12 months of wages and salaries paid in a financial year, it provides better insights about underlying growth.

The health care and social assistance services industry held the largest share of total wages and salaries, making up almost 15% of the total.

The public administration and safety industry saw the second largest growth in dollar terms, influenced by large state government pay rises and one-off payments such as backpay.

Don't miss the Business program tonight

Stockland chief executive Tarun Gupta will be on the Business program with Alicia Barry tonight.

(Remember, it's been one of the top performing stocks today after bumper profit results).

Mr Gupta has issued a warning that there could be another bottleneck in construction if skills shortages aren't immediately addressed.

Also on the program, the Association of Superannuation Funds of Australia (ASFA) chief executive Mary Delahunty will talk about super reform.

Super has been a hot topic at the economic roundtable in Canberra today and she'll share her insights.

Watch at 8.45pm (AEST) on ABC News Channel or after the late news on ABC TV.

Canva launches employee stock sale

Australian graphic design platform Canva has launched an employee stock sale, valuing the company at $42 billion (A$65 billion).

Company employees are able to sell shares to both new and existing investors, including Fidelity Management and JP Morgan's asset management division, reports Bloomberg.

Launched in 2013, Canva has more than 240 million monthly active users across 190 countries.

-with Reuters and Bloomberg

Buyer's agent warnings

The Real Estate Buyers Agents Association of Australia has called for tighter regulations of buyers' agents.

A buyer's agent is hired to represent the buyer by finding, evaluating, and negotiating a property purchase on their behalf.

The association has warned that inexperienced buyer's agents are causing headaches for customers.

Some online courses offer buyer's agent qualifications for as little as $200, but Ms Jennison said they failed to teach key legislative requirements.

REBAA estimates around 2,000 buyer's agents are working in Australia, though no official figures exist.

University rules out further forced redundancies

The Australian National University says there will not be further forced job cuts as part of its restructure.

However, where the university has already announced a savings plan, in the College of Arts and Social Sciences and the School of Music, forced redundancies will go ahead.

The university says it will save $60 million through salary reductions, with $40 million to go.

It is part of a broader target of saving $250 million.

You can read more about this story here:

Bitcoin falters

Bitcoin is not having a good month and could face its first monthly loss since March.

It's risen 66% since April, with four months of straight gains.

Tony Sycamore, a market analyst with IG, says cracks began to appear late last week.

"The pullback intensified after a scorching US PPI inflation report, which dampened expectations for aggressive Federal Reserve rate cuts into year-end, impacting risk appetite across crypto markets."

The cryptocurrency's retreat has been compounded this week by a sell-off in overvalued tech stocks (which are correlated with cryptocurrencies).

Have a look at this monthly chart from TradingView:

Mr Sycamore says the next moves for bitcoin will likely depend on risk sentiment, the performance of tech stocks and any remarks by the Fed Chair Jerome Powell at the next Jackson Hole Symposium.

What's going on at HMC Capital?

You will have noticed real estate asset manager HMC Capital has been one of the top-performing stocks today.

It was up around 16% at lunchtime.

It comes after the stock actually fell more than 6% yesterday, finishing at a near five-year low, after reporting disappointing earnings.

However, investor confidence seems to be up, with Morgans analysts upgrading their position on the stock from "hold" to "buy".

Lottery Corporation shares hit all-time high

Lottery Corporation is one of today's biggest gaining stocks on the ASX200.

The lottery operator posted a net profit of $366 million, which was down 12 per cent on the previous year (which was also a record jackpot year).

Managing Director Sue van der Merwe says the company's portfolio diversification and active management helped to deliver a "resilient performance" this year.

"The defensive characteristics of lotteries were evident, with customer participation remaining healthy, even as players sought value in a challenging economic environment."

The company declared a final dividend of 8.5 cents per share, taking the total dividend to 16.5 cents per share.

Earnings were slightly higher than analyst expectations, but investors must be happy because the stock price lifted almost 9%, hitting an all-time high of $5.76.

Lottery Corporation is currently up 7.8 per cent to $5.70 (as at 1.35pm AEST).

Bendigo Bank flags half a billion dollar impairment

Bendigo and Adelaide Bank says its second half net profit will be impacted by a $540 million goodwill impairment.

In a statement to the ASX, the bank says the impairment has been significantly driven by an increase in the discount rate used in the goodwill impairment testing and a "balanced approach" to global uncertainty.

Net profit will also be impacted by restructuring costs (after tax) of $9 million, due to the closure of 10 corporate branches.

The bank says the adjustments will not impact cash earnings.

Bendigo Bank shares are down -0.9 per cent to $12.78 (as at 1.25pm AEST).

Reno From Hell: the RBA's Martin Place HQ renovation blows out, again

Riddled with asbestos.

Almost 290% over budget.

More than four years late.

And now things are reportedly worse.

Last year, I received documents and wrote about the Reserve Bank's horror renovation drama.

As the presentation dryly noted, as it talked about the insane explosion in costs...

"Additional cost of $823.3M. New total costs of $1,089.9M. Extends delivery time by 4 years to November 2029."

For decades, its flagship Martin Place headquarters has long loomed over the nearby buildings that store much of Australia's capital and the people making the big investment decisions.

(Until the inevitable compounding growth of superannuation means that the profit-to-member funds based on Lonsdale Street in Melbourne are now where you go if you want billions or trillions to play with).

Today, Michael Read in The Australian Financial Review has an update: the cost of renovating the asbestos-riddled office has risen further to $1.2 billion.

The length of the project — and the ever-ballooning cost — prompted the newly installed governance board of the RBA to consider selling the building and walking away from the troubled project.

In his reporting, the RBA’s governance board discussed the project at its meeting on Monday, after commissioning an analysis about whether the renovation was worth continuing.

"The board was told the cost of the project had reached about $1.2 billion — more than 4.5 times its original budget – a source said. That figure does not include the $45.8 million spent so far on leasing space at 8 Chifley Square, which will need to be renewed when it expires in June 2028."

The AFR reports that the board found continuing with the renovation was still the cheapest option for the central bank —which was the result the bank got to the last time we looked at this, before it was examined again after this latest sensational cost blowout.

Why so hard? Not only does the building hold important "market infrastructure", but it is heritage-listed.

To make things harder, it has so much potentially deadly asbestos that the plan is to essentially trim it back to the steel girders to clean it all away — yes, high above the Sydney skyline — and then build the structure back.

If you're getting your bathroom re-tiled and about to complain about the cost, this might put in in perspective.

Then again, the RBA is rare amongst renovators in that it gets to print its own money.

Could NZ's cash rate get to 2.5 per cent?

New Zealand's Reserve Bank has cut the official cash rate to 3 per cent, in line with economists' expectations.

It is the seventh rate cut over the past 12 months.

Abhijit Surya, senior economist at Capital Economics says the bank signalled there is more easing in the pipeline.

"Accordingly, we're more confident than ever in our below-consensus terminal rate forecast of 2.5 per cent," he wrote in an analyst note.

He says the fact the bank even discussed a 0.5 percentage point rate is quite telling.

"The main reason that the Committee feels the need to provide more policy support is its more downbeat outlook for the domestic economy," he said.

"The Bank made broad-based downgrades to its forecasts for GDP growth, the unemployment rate and private-sector wage growth in its latest Statement on Monetary Policy, consistent with the economy remaining in a state of excess capacity for the foreseeable future."

The bank did revise up its near-term forecast for headline inflation, which it expects to hit the top of its 1-3 per cent target band this quarter.

Westpac's Imre Speizer says the bank retained its easing bias, but the official cash rate outlook was more dovish.

Market update for the middle of the trading day

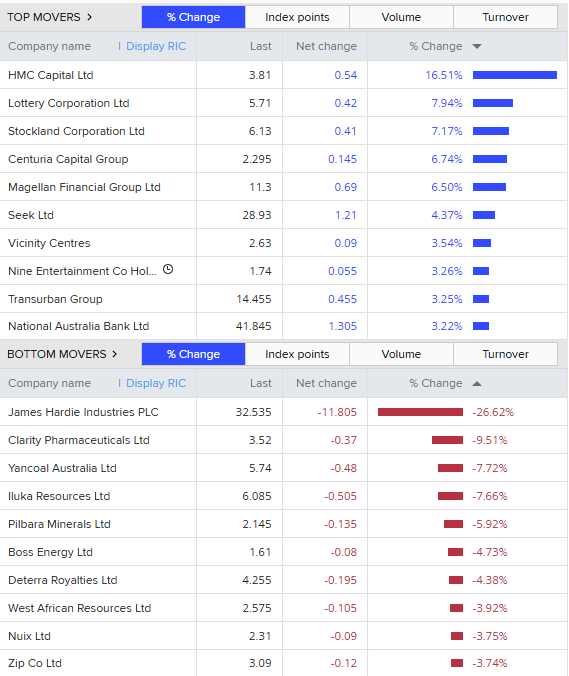

The local share market is up today, despite tech-driven falls on Wall St overnight.

The ASX200 is up 0.4% to 8,929 points while the broader All Ordinaries is up 0.24% to 9,195 points (as at 12.30pm AEST).

Financials, real estate and consumer cyclicals are up today, while energy and basic materials are dragging.

In terms of individual stocks, HMC Capital (+16.5%), Lottery Corporation (+7.9%) and Stockland (+7.2% to a 17-year high) are leading the best performers.

James Hardie is the worst performer, dropping a massive -26.6% after reporting below consensus first quarter results and forecasts.

Why have James Hardie shares plunged as much as 30%?

Let's take a look.

James Hardie Industries has delivered disappointing first- quarter results and updated guidance for this financial year.

It lost as much as $7.7 billion in value in the first 40 minutes of trading today.

It's been hit by a sharp slowdown in its North American market (where the company makes about three-quarters of its profits).

It says housing construction will be flat in Australia until early next year.

RBC Capital Markets analyst Matthew McKellar says earnings and sales across North America, Asia Pacific and Europe were below forecasts.

"We expect shares of James Hardie to come under pressure on FQ1, 26 results that were below consensus and on updated guidance for FY26 that suggests adjusted EBITDA at the mid-point of the range that is ~21 per cent below FactSet consensus," he said.

James Hardie shares are current down -26.4% to $32.63 (as at 12.30pm AEST).

Market snapshot at lunchtime

- ASX 200: 0.4% to 8,932 points

- All Ordinaries: 0.2% to 9,192 points

- Australian dollar: -0.1% at 64.5 US cents

- Wall Street: Dow Jones (flat), S&P 500 (-0.6%), Nasdaq (-1.5%)

- Europe: FTSE (+0.3%), DAX (+0.5%), Stoxx 600 (+0.7%)

- Spot gold: flat at $US3,314/ounce

- Oil (Brent crude): +0.2% to $US65.9/barrel

- Iron ore: -0.8% to $US100.70/tonne

- Bitcoin: -0.2% to $US113,349

Prices current around 12:25am AEST

Live updates on the major ASX indices:

NZ central bank cuts rates by 0.25 percentage points

New Zealand's central bank has cut its official cash rate to 3%, a three-year low.

According to the minutes of the meeting, the committee discussed three policy options, keeping the cash rate on hold, cutting by 0.25 percentage points or cutting by 0.50 percentage points.

The committee voted four votes to two to decrease by 0.25 percentage points.

Some committee members thought a larger cut emphasised declining inflationary pressure and significant spare capacity.

However, the case for the smaller cut was based on the upside and downside risks around the central projection being broadly balanced.

If medium-term inflation pressures continue to ease in line with the committee's central projection, the committee expects to lower the cash rate further.

The NZ2 50 index edges higher on the news, while the New Zealand dollar falls as much as 0.8% to $0.5845.